Table of Contents

1. Diversification:

2. Thorough Research and Analysis:

3. Long-Term Investing:

5. Regularly Rebalance Your Portfolio:

6. Stay Emotionally Detached:

7. Continuous Learning:

8. Leverage Technology for Informed Decision-Making:

9. Cultivate a Disciplined Investment Routine:

1. Diversification:

Looking to Maximizing Profits in the Stock Market diversity is the foundation of a solid investment portfolio. To reduce risk, diversify your investments across industries and asset classes. By avoiding overconcentration on a single stock or industry, you can shield your portfolio from the effects of underperforming assets and market changes, resulting in a more steady and potentially rewarding financial journey.

2. Thorough Research and Analysis:

In today’s fast-paced stock market, information is power. Conduct thorough research on potential investments, analyzing financial statements, market trends, and relevant news. Stay updated on the latest developments in the industries you’re interested in. This commitment to information allows you to make strategic and well-informed investment choices, enhancing your chances of success.

3. Long-Term Investing:

While the allure of day trading may be strong, the most successful investors often adopt a long-term perspective. Patiently holding onto quality equities over time allows you to ride out market swings and get the benefits of compounding. Long-term investing aligns with the principle of ‘time in the market, not timing the market,’ offering a more sustainable approach to wealth accumulation.

4. Risk Management:

Effective risk management is critical in the stock market. Set defined risk tolerance levels, diversify your investments, and use stop-loss orders to preserve your wealth. Creating a risk management strategy is critical for long-term success in the stock market, as it allows you to handle uncertainty while protecting and growing your investment portfolio.

5. Regularly Rebalance Your Portfolio:

Market conditions vary, as should your investing portfolio. Regularly examine and adjust your portfolio to ensure it is in line with your financial objectives and risk tolerance. Adjusting your investments based on changes in market conditions can help you maximize returns and minimize risk, ensuring that your portfolio remains well-aligned with your investment objectives.

6. Stay Emotionally Detached:

Emotional discipline is a hallmark of successful investors. Emotions such as fear and greed can obscure judgment and cause rash actions. You can confidently navigate market turbulence by being emotionally detached and adhering to well-thought-out financial strategy. This disciplined approach is key to achieving long-term financial success.

7. Continuous Learning:

The stock market is dynamic and constantly evolving. Attend seminars, read books and articles, and remain current on new investment ideas and market trends. A commitment to ongoing education will empower you to make more informed decisions and adapt to the ever-changing landscape of the stock market.

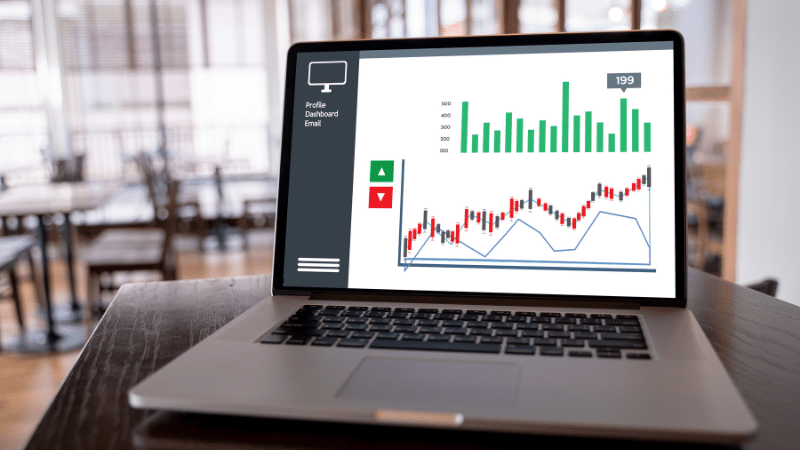

8. Leverage Technology for Informed Decision-Making:

In the digital age, technology may be an effective ally for investors. This section will explore how leveraging financial tools, data analytics, and investment platforms can provide real-time insights, helping you make informed decisions. Stay abreast of technological advancements to gain a competitive edge in analyzing market trends and optimizing your investment strategy.

9. Cultivate a Disciplined Investment Routine:

Consistency is essential in stock market investing. Develop a disciplined investment routine that includes regular portfolio reviews, market analysis, and goal reassessment. This part will emphasize the importance of sticking to your established routine, avoiding impulsive decisions, and maintaining a steadfast commitment to your long-term financial objectives.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.